The Basic Principles Of Pvm Accounting

The Basic Principles Of Pvm Accounting

Blog Article

The Ultimate Guide To Pvm Accounting

Table of ContentsWhat Does Pvm Accounting Do?The Of Pvm AccountingThings about Pvm AccountingThe Buzz on Pvm AccountingOur Pvm Accounting IdeasPvm Accounting for Beginners

Oversee and handle the creation and approval of all project-related payments to clients to foster great interaction and prevent concerns. financial reports. Make sure that appropriate records and documentation are sent to and are updated with the internal revenue service. Ensure that the accountancy process abides by the law. Apply needed construction accounting requirements and treatments to the recording and reporting of building activity.Understand and preserve standard expense codes in the audit system. Communicate with various funding agencies (i.e. Title Business, Escrow Business) pertaining to the pay application procedure and needs needed for settlement. Manage lien waiver disbursement and collection - https://www.mixcloud.com/pvmaccount1ng/. Display and resolve bank problems consisting of fee anomalies and check differences. Assist with applying and maintaining internal financial controls and procedures.

The above declarations are planned to define the basic nature and degree of job being executed by individuals appointed to this category. They are not to be understood as an extensive checklist of obligations, obligations, and abilities required. Personnel may be required to execute obligations beyond their normal responsibilities every now and then, as needed.

See This Report on Pvm Accounting

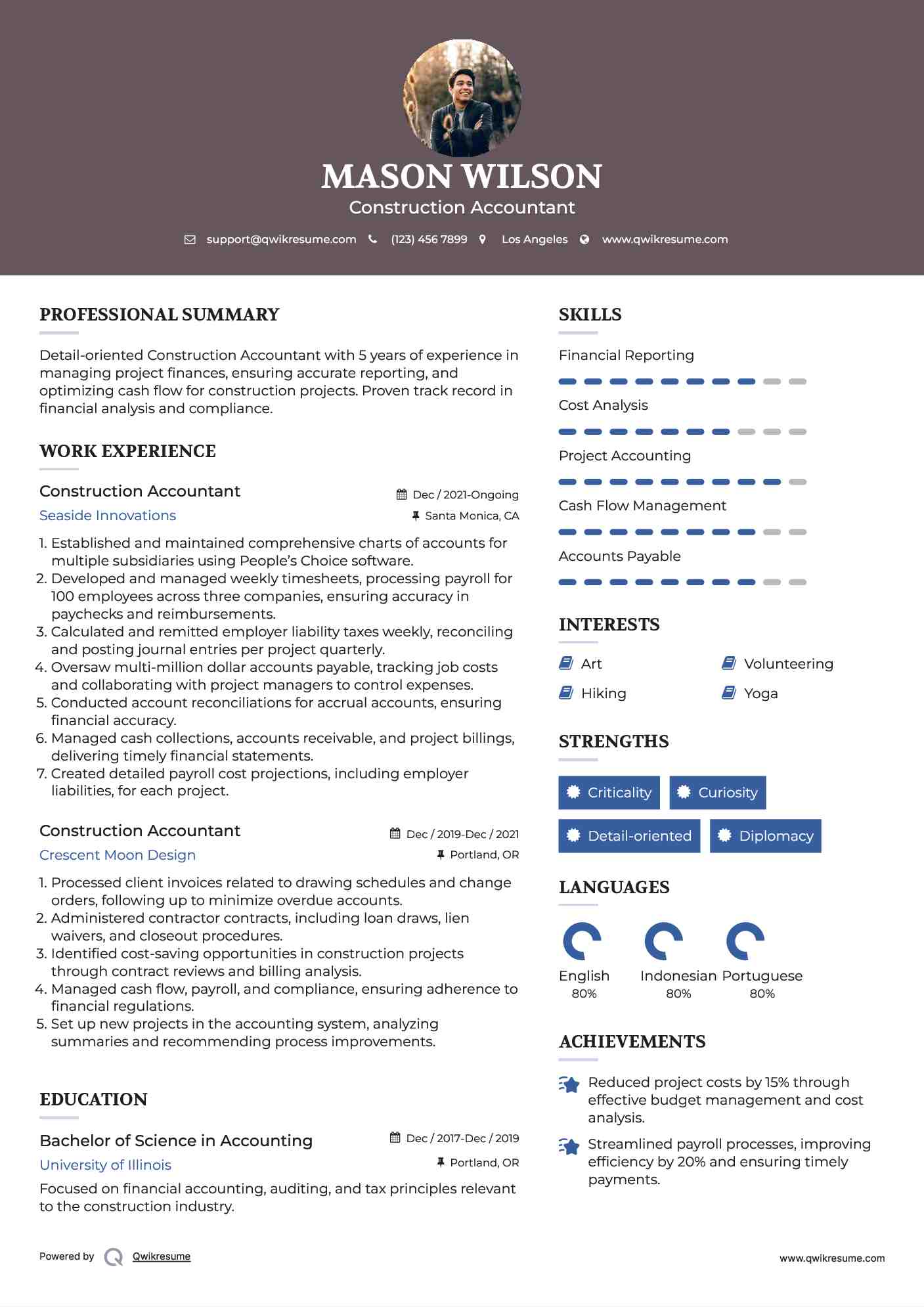

Accel is looking for a Construction Accounting professional for the Chicago Workplace. The Construction Accounting professional performs a selection of bookkeeping, insurance policy conformity, and task management.

Principal tasks consist of, but are not limited to, handling all accounting functions of the firm in a prompt and accurate way and giving records and timetables to the firm's certified public accountant Firm in the prep work of all financial statements. Makes sure that all bookkeeping treatments and features are taken care of accurately. Responsible for all financial documents, pay-roll, banking and daily procedure of the bookkeeping function.

Prepares bi-weekly trial balance reports. Functions with Task Supervisors to prepare and post all regular monthly invoices. Processes and issues all accounts payable and subcontractor settlements. Generates month-to-month wrap-ups for Employees Settlement and General Obligation insurance premiums. Generates regular monthly Work Price to Date records and functioning with PMs to resolve with Job Supervisors' spending plans for each task.

More About Pvm Accounting

Efficiency in Sage 300 Construction and Genuine Estate (formerly Sage Timberline Office) and Procore building and construction management software program a plus. https://www.goodreads.com/user/show/178444656-leonel-centeno. Must additionally excel in other computer system software systems for the preparation of reports, spreadsheets and various other bookkeeping evaluation that may be needed by management. construction taxes. Must possess solid organizational skills and ability to focus on

They are the economic custodians who make sure that construction jobs remain on budget plan, adhere to tax guidelines, and keep economic transparency. Building and construction accounting professionals are not just number crunchers; they are tactical companions in the building and construction procedure. Their primary function is to handle the financial elements of building and construction projects, guaranteeing that resources are allocated successfully and monetary dangers are decreased.

The smart Trick of Pvm Accounting That Nobody is Discussing

They work closely with task supervisors to develop and check spending plans, track expenditures, and projection economic needs. By preserving a tight grasp on project finances, accountants aid stop overspending and economic troubles. Budgeting is a keystone of effective building projects, and building accountants are instrumental in this respect. They produce thorough budget plans that include all project expenditures, from products and labor to permits and insurance coverage.

Building and construction accountants are fluent in these guidelines and guarantee that the task complies with all tax needs. To excel in the function of a construction accountant, people require a strong educational foundation in accountancy and money.

In addition, certifications such as Certified Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Construction Market Financial Professional (CCIFP) are highly regarded in the sector. Building and construction tasks frequently involve limited target dates, altering guidelines, and unforeseen costs.

Not known Details About Pvm Accounting

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

Professional certifications like certified public accountant or CCIFP are likewise highly advised to demonstrate proficiency in building and construction audit. Ans: Building accounting professionals produce and keep an eye on budgets, identifying cost-saving chances and guaranteeing that the task remains within spending plan. They additionally track costs and projection economic demands to stop overspending. Ans: Yes, building accounting professionals manage tax compliance for building and construction tasks.

Introduction to Building And Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building business have to make difficult selections among see many monetary alternatives, like bidding process on one job over another, picking financing for products or equipment, or establishing a task's earnings margin. On top of that, building and construction is a notoriously unpredictable market with a high failure price, slow time to repayment, and irregular money circulation.

Typical manufacturerConstruction service Process-based. Manufacturing includes duplicated procedures with quickly identifiable prices. Project-based. Production calls for various processes, materials, and tools with varying prices. Taken care of location. Production or manufacturing happens in a solitary (or a number of) regulated places. Decentralized. Each project happens in a brand-new location with differing site problems and distinct obstacles.

What Does Pvm Accounting Mean?

Regular use of various specialized contractors and providers affects efficiency and cash flow. Payment arrives in full or with regular payments for the complete agreement quantity. Some section of settlement might be kept up until project completion even when the professional's work is ended up.

While standard manufacturers have the benefit of controlled settings and enhanced manufacturing processes, building and construction business must constantly adjust to each new job. Also somewhat repeatable tasks need modifications due to website conditions and other variables.

Report this page